Dr Gindo Tampubolon, Lecturer in Poverty, Global Development Institute

The story of mobile money in Africa, such as Mpesa, is one of the success stories to have arisen from the continent in recent years. A World Bank report in 2016, featured mobile money services, together with innovations from other places, to illustrate how digital technologies are yielding digital dividends in development. Specifically, the report highlighted the prevalence of smartphones. With their spread, digital technologies are having a huge impact by enhancing inclusion, increasing efficiency and enabling innovation.

Not just in Africa are digital technologies enabling innovation. In Indonesia for instance, our team has successfully put together a complex social-technical-medical intervention which has at its heart a mobile app in the hands of village health volunteers, that enables effective control of cardiovascular risk outside hospitals and within communities. In an editorial commentary on the intervention, cardiologists noted that empirically such complex interventions have often failed to yield the expected digital dividends in health. A previous GDI blog explains how, through mobile technology, we are tackling cardiovascular disease risk in rural Indonesia.

In Africa, however, mobile money services are spreading dividends on the back of the diffusion of mobile phones. Financial services are liable to be disrupted by digital technologies; not least by transforming the supply side of banks with machine learning. So a new landscape of financial services is being rewired by digital technologies, enhanced by financial inclusion and particularly digital financial inclusion. Using a survey from last year, we are able to examine the latest picture of the use of digital technologies in ten African countries (Survey of household and individual ICT access and use 2017–2018). The empirical analysis suggests that considerable digital dividends are foregone in these countries.

Financial inclusion and exclusion

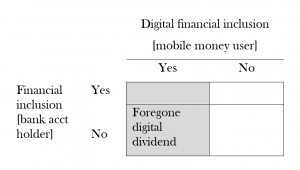

I distinguish between financial inclusion and digital financial inclusion as they emphasize different mechanisms in the economy. On this basis I then propose a new index of foregone digital dividends. The first indicator or financial inclusion, as defined by the World Bank, is measured by the rates of bank (financial institution) account ownership in the adult population. The definition in terms of banks or financial institution recognises the fundamental role of banks in pooling funds (savings) and allocating them (investments) in macroeconomic management.

In the successful story of East Asian countries, for example, saving rates or financial inclusion is a distinguishing factor responsible for their remarkable economic growth. High levels of financial inclusion indicate effective pooling of financial resources which were then allocated to entrepreneurs and governments and used as investments. Conversely, low levels of financial inclusion translate to real constraints in macroeconomic management. It is therefore a priority to explore the survey and find determinants of financial inclusion in African countries.

Equally, high levels of financial inclusion enable better economic management by the government since formal regulations of the banks furnish information invaluable for making policy (‘the financial pulse of the economy’). Low levels of financial inclusion deny policy makers key information for effective economic management. The determinants of financial inclusion are necessary data..

Pooling of funds (or savings) and allocation of funds (or investments) are not the only important banking functions. Banks also support daily commercial transactions or transfer of funds, reducing transaction costs and enhancing economic performance. But daily transactions are increasingly carried out outside traditional banks as the story of mobile money highlights. The technologies enable anyone with a mobile phone to conduct financial transactions in a timely and efficient manner.

So irrespective of whether the pooling and allocating of funds are effectively provided for a client (much depends on the supply side), a mobile money service for peer-to-peer transfer can make a lasting difference for a person. It follows that financial inclusion can be usefully distinguished from digital financial inclusion. Access to mobile money services through a smartphone is thus an indicator of digital financial inclusion, the second key indicator examined here.

The third key indicator is digital financial exclusion as a measure of foregone digital dividends. Digital financial exclusion is defined only among mobile money users, picking those without a bank account (the grey column in the Figure 1). This last indicator is created because among mobile money users, the demand for financial services is real as revealed by their use of the service. These users are therefore primed to demand broader financial services such as longer term saving and timely investments. The fact that they are still financially excluded indicates foregone digital dividends.

Scheme 1. Financial inclusion, digital financial inclusion and foregone digital dividend definitions.

Put differently, the deeper the gap between financial inclusion rates and mobile money user rates, the larger the benefit foregone by the financial system. This is increasingly recognized by both bankers and mobile money service providers. In Indonesia, for instance, this recognition is becoming clearer among bankers from large state owned banks (Mandiri, BNI) and officials from GoJek which provides mobile money services.

In short, there are three questions to ask of the new data: what are the determinants of financial inclusion in Africa? Similarly, of digital financial inclusion? And what are the determinants of foregone digital dividends?

Analysis of Survey of ICT use in ten African countries

I obtained answers to these questions using a new survey from Ghana, Nigeria, South Africa, Mozambique, Rwanda, Kenya, Tanzania, Lesotho, Uganda and Senegal. The survey collected a rich set of information from adults 15 years and older including: age, gender, location (rural or peri/urban), education, incomes, marital status, household size, access to the internet and personal computers, literacy, number of household members with mobile phones.

Financial inclusion is an indicator of owning a bank/financial institution account. Digital financial inclusion is an affirmative response to the survey question: have you ever used mobile money services (Mpesa or e-Wallet)? Foregone digital dividend is defined in the scheme above. Probabilities of financial inclusion, digital financial inclusion and foregone digital dividends for various covariates are estimated using probit models.

The data show in Table 1, key variables in 2018 sorted according to average national income or GDP per person (South Africa has the highest average income). Financial inclusion (second column) shows a trend which accords with the average national income: as income increases financial inclusion also increases, with exceptions such as Mozambique which shows higher than expected level of financial inclusion given its low average income.

| Country, n | Financial inclusion | Digital financial inclusion | Digital financial exclusion |

| South Africa, 1809 | .61 | .08 | .02 |

| Ghana, 1198 | .33 | .56 | .29 |

| Nigeria, 1802 | .45 | .04 | .001 |

| Kenya, 1208 | .43 | .88 | .45 |

| Senegal, 1230 | .12 | .35 | .27 |

| Lesotho, 2158 | .28 | .37 | .21 |

| Tanzania, 1197 | .21 | .56 | .37 |

| Rwanda, 1203 | .35 | .34 | .13 |

| Uganda, 1858 | .09 | .47 | .39 |

| Mozambique, 1160 | .26 | .24 | .11 |

| Total, 14823 | .31 | .39 | .22 |

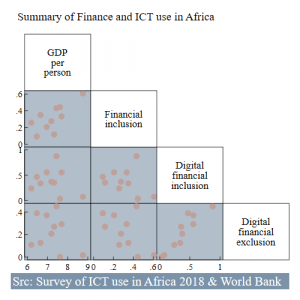

The same data are presented in a series of plots which reveal more than the above trend (Figure 1). The top left plot shows that financial inclusion positively correlates with average national incomes. But there is no strong correlation between financial inclusion and digital financial inclusion.

Finally, at the bottom right plot, it shows a strong correlation between digital financial inclusion and digital financial exclusion. This inclusion-exclusion correlation pattern might at first appear puzzling. Digital financial exclusion is defined among those users of mobile money, specifically if they do not own a bank account. This plot shows that the more people use mobile money, proportionately more of them are excluded from the conventional banking system. If we assume that use of mobile money encourages users to access broader kinds of financial services, evidently there are considerable foregone digital dividends in these countries.

Figure 1. GDP per person, financial inclusion, digital financial inclusion and digital financial exclusion in ten African countries.

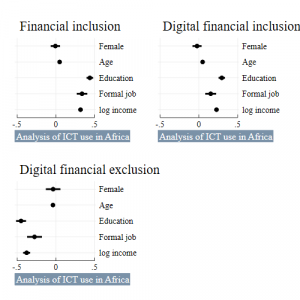

If these dividends were to be reaped, we need to understand the determinants of financial inclusion, digital financial inclusion and exclusion. The results of a series of probit models explaining probabilities of inclusion and exclusion are seen below (Figure 2). They show that education and personal incomes are significant for financial inclusion and its digital form. Having a formal job matters for financial inclusion and digital financial inclusion, more so for financial inclusion (top left pane) than for digital financial inclusion (top right pane). This difference accords with the fact that mobile money services are widely used in the informal sector. The picture of foregone digital dividend or digital financial exclusion is a converse of this story. For the same rates of mobile money users across two locations, education, formal jobs and personal incomes are the key factors that correlate with whether someone uses a bank service.

Figure 2. Determinants of financial inclusion, digital financial inclusion and digital financial exclusion in ten African countries [n = 14823]. Other covariates included are country fixed effects, rural versus urban location, number of household members with a mobile phone, household access to the internet, literacy, own a personal computer and marital status.

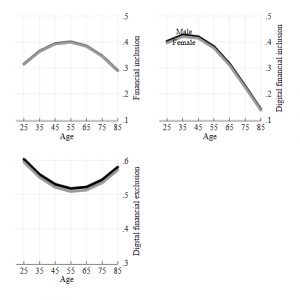

Second, digital financial inclusion and financial inclusion peaked far apart in the life course, 35 versus 55 years. This is consistent with a generation game of financial inclusion which arises from the life cycle of financial needs. The younger generation needs more transaction services (conveniently offered by the digital financial services) while the older generation needs more investment services (offered by the conventional financial services for housing, portfolio and pension investments).

Lastly, among adults with demand for financial services (mobile money users), exclusion from formal financial services largely reflects the converse of financial inclusion. Thus the experience of digital financial inclusion has so far failed to induce demand for financial inclusion. If the increasing trend in digital financial inclusion (World Bank report 2016) is not caught by the trend in financial inclusion, then more digital dividends are foregone and the constraints in economic management remain. So transforming the supply side is important, for instance through adopting machine learning technology to efficiently broaden services offered.

Figure 3. Marginal probabilities of financial inclusion, digital financial inclusion and digital financial exclusion in ten African countries.

In sum, although the figures uncovered raise more questions, some answers to the initial questions can be suggested. Financial inclusion, digital financial inclusion and foregone digital dividends are shaped by age and cohort effects, making financial inclusion peak later. Education and formal jobs are important especially for financial inclusion. Efforts to broaden financial inclusion so that younger people get on board earlier should be considered in efforts to include more citizens into an efficient financial system.

Crucially, putting too much stock in mobile money services maybe misguided. The service experience on the demand side is ineffective to bring the users into the fold of the banking system. Supply side transformation is needed. An inclusive financial system where citizens participate early and actively is a strong determinant of inclusive development.

Trackbacks/Pingbacks